Don’t be a dummy and save your money

March 10, 2020

Once you get older, it’s time to start getting money to pay for everyday items on your own. You shouldn’t spend all of your money on everything you want. It’s more or less like a mental game, on deciding if you need it or want it.

We should start to save as young as you can. A good time to first start making money is at a young age. Saving money right now will only help you in the future. Get some good habits in right now with money when you are young, so that as you get older, it will be just a habit that you do. Some adults right now regret not starting to save money early in life. They say it is better to start younger because it will get you into a habit.

Data Behind Saving Money

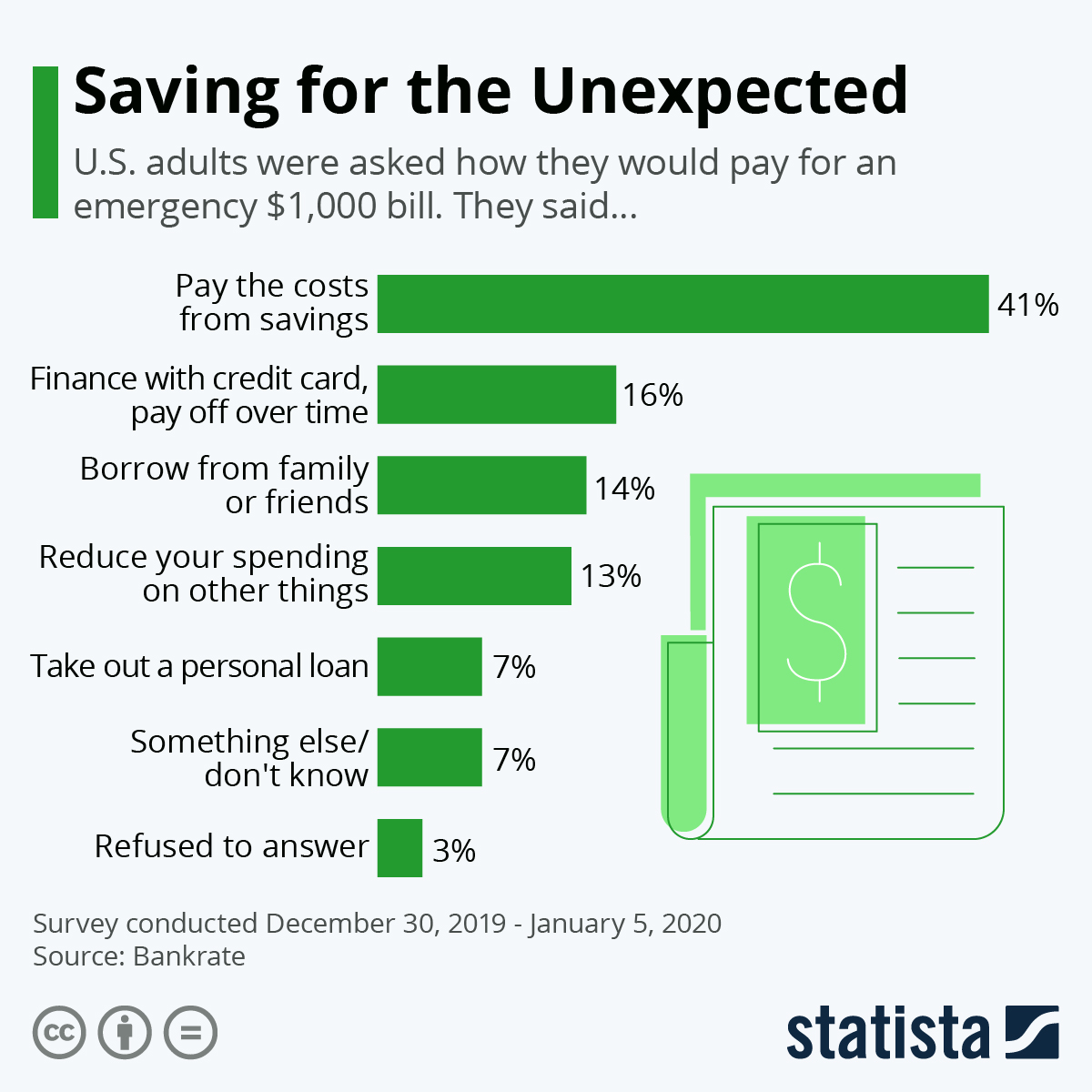

Two-thirds of Americans would struggle to scrounge up $1,000 in an emergency.

“I think money is more critical now that I have to be a responsible adult and my kids rely on me.” Mrs. Davies an English ten teacher added.

38 percent of working Americans have too many expenses. Across different income levels, age groups and regions, that’s the most common reason we aren’t saving more money.

“Money is just a means to do the things I would like to do. I also want enough to not worry too much about my future.” Gretchen Borst a Multicultural Literature teacher verbalized.

Saving money now will help in your future. If you plan to attend college, buy a house or a car, having money saved will help you. Doing this means you will not have to ask for anyone for money in order to buy something. Or if an emergency happens and you need the money you can use your savings.

Set Goals for Yourself.

Set goals for yourself. Make some goals every week on how much you need to save. Having your head wrapped around what you need to have by a certain amount of time is good and a responsible action to do. Every week you can set aside the money you need to pay for bills. Whether it’s for each day, week, or month, set saving targets and stick to them. A savings calculator will give you an indication of how long it will take to reach your goal.

“Try to save what you can right now. Set limits for yourself so you don’t spend all your money. NEVER spend more money than you have. (be careful with credit cards!!)” Valerie Davies

Learn From Others and How to Not Need Money

Just because you’re a teenager, doesn’t mean you have to do all the of the in’s and out’s of what a “teenager” does. Going to parties and doing illegal junk isn’t worth the money at the moment compared to what you need in the future. Some students don’t go to every Jenison event because is it worth the money to do that junk or would it be better they had money for something more important. It’s important to not give up what you want most for what you want now. “FOMO is fear of missing out. It’s easy to think everyone is having more fun than you are when you’re a teenager. And sometimes, people are having more fun than you. That’s true no matter how young or old you are. It’s important, though, to not give up what you want most for what you want now.”

“Educate yourself about what money strategies exist out there. It is silly to be ignorant about it or pretend it doesn’t matter what you know. Listen to the money people who know about what they are talking about and tailor their ideas to your own values and ideas. If you start out right now paying attention to money strategies, it can be rewarding as you start edging toward the job(s) you will have as a graduate! It feels good to be in control of money instead of the other way around.” Gretchen Borst

Tips and Tricks

On the first day of a new month, get a receipt for everything you purchase throughout the month. Stack the receipts into categories like restaurants, groceries, and personal care. At the end of the month you will be able to see where your money goes. Additionally, your bank or credit union may have this as an online-banking feature. Seeing what you spend in total on food, shopping, etc..

Calculate purchases by hours instead of cost This mental math tactic helps you to #ThinkLikeASaver. Take the amount of the item you want to purchase and divide it by your hourly wage

Kelly Kirkland, the CTE director at Jenison High School stated, “I set aside some at every paycheck (goes directly into an account so I never see or miss it) and if I have extra at the end of my pay period I put it away into a separate account. I take it out on “special occasions” only and take out part of the money and do not spend again till that is payback plus some.”

Determine a set amount of money to put away every month and treat it like any other bill. Put away part of every paycheck — 10 to 12 percent — and watch your savings grow. Save now. Choose the right savings methods to match your goals, and make sure to do your research to find the best interest rates.

Conclusion

It’s simple to start saving, it’s more of having the right mindset. Think about your future and what you would want to have and start planning for it right now. It will help with your stress. “By working hard , living cheap you can save money.”